BCA mobile existence as banking app has made it easier for Indonesian people to carry out any transaction to fulfil their daily needs.

With BCA mobile, you can do many transactions, such as top up e-wallets, money transfers, pay monthly bills, and check transaction history.

Therefore, it is difficult to imagine if you intentionally or accidentally entered the wrong BCA mobile access code several times in a row that locked you out of access. It could interfere with your financial activities.

According to the provisions, you will be locked out of access to BCA mobile if you enter the wrong access code 3 times in a row when logging in to the app. Here’s what you need to do:

1. Stay Calm and Don’t Panic

The first step to do when you know that you have been locked out of access is to stay calm and not panic. Panic usually makes things worse. You won’t be able to think clearly and find the best solution.

Furthermore, if you can’t access and use BCA mobile to perform financial transactions, you can still use the ATM BCA card for transactions at the ATM BCA machine and offline payments using the EDC machine. You can still access other BCA internet banking facilities, such as KlikBCA and myBCA.

2. Reset via BCA mobile

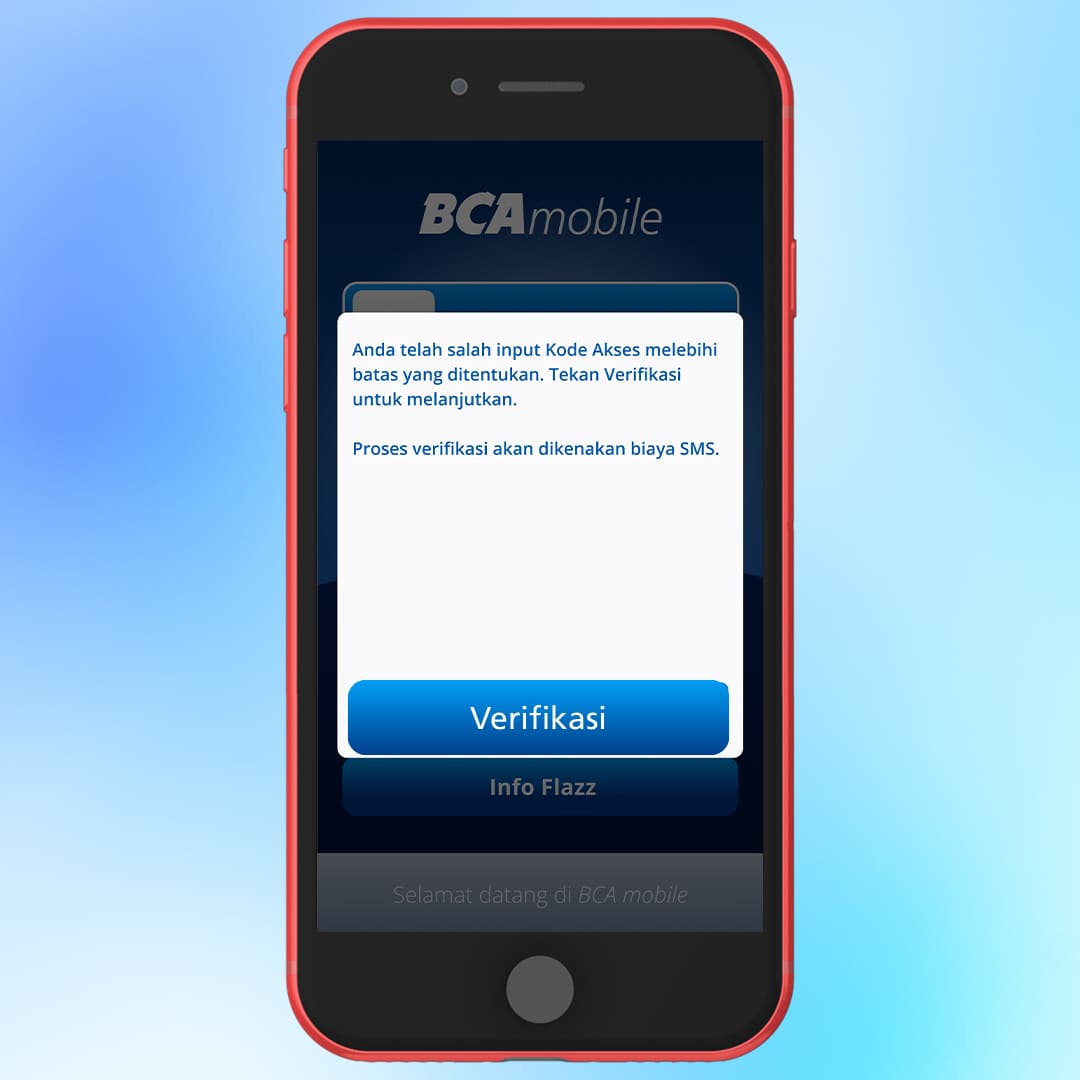

The first easy way to solve a blocked access code BCA mobile can be done through the BCA mobile app itself. If you forget the access code and a notification like this appears, don’t worry because you can re-verify directly on the BCA mobile app.

Here are the steps that you can follow:

- Select m-BCA or menu (i) in the upper right corner

- Select ‘Verifikasi’

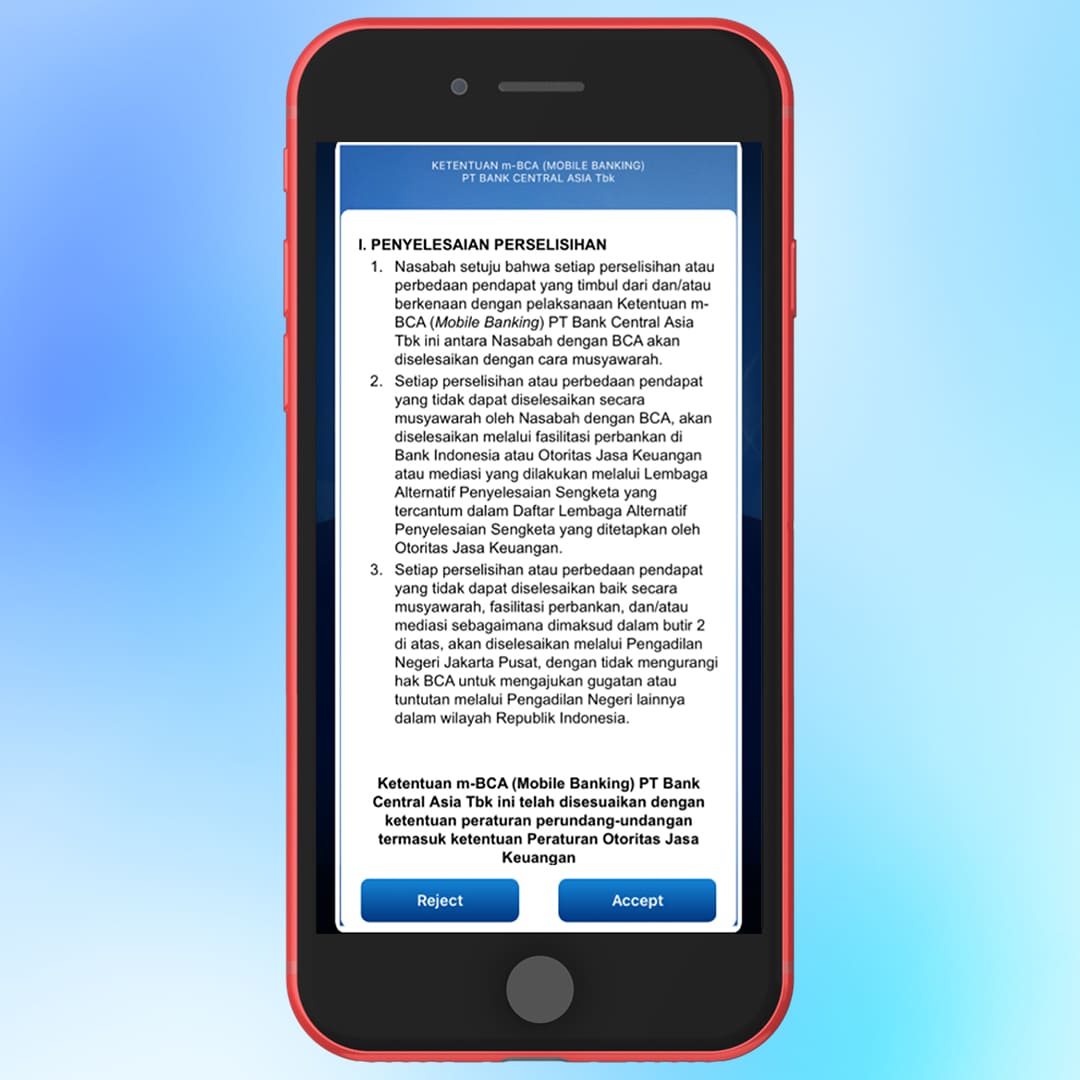

- Click ‘Accept’ to the Terms and Conditions to use BCA mobile banking

- Enter your ATM card number

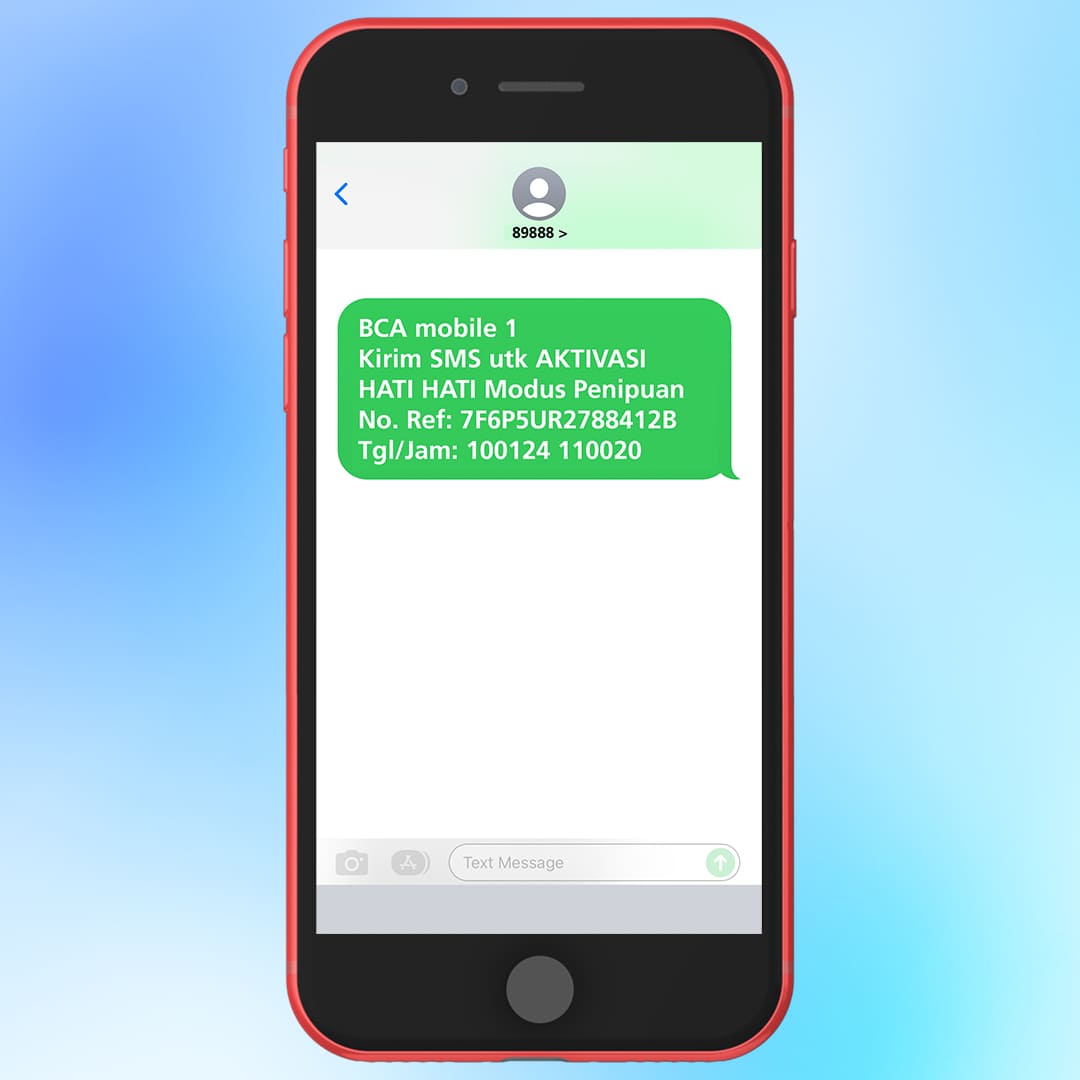

- Send SMS to 89888 as directed for verification

- If successful, enter a new Access Code and repeat once more for verification

- BCA mobile can now be accessed

3. Contact Halo BCA

If you are confused, simply contact Halo BCA for help. There are many ways to contact Halo BCA, including via Bank BCA WhatsApp at +62811-1500-998, hotline 1500888 (without any prefixes or codes), or the haloBCA app (toll-free).

To avoid bank fraud, double-check to ensure the phone numbers and social media accounts are the official BCA contacts. BCA’s official Instagram account is @GoodlifeBCA with a blue verified badge. Check all official BCA social media accounts here.

If you choose to verify BCA mobile at the nearest branch, our bank officer will help you go through the verification process yourself via the app. Once it’s done, you can use BCA mobile for mobile banking transactions.

4. Tips to Make BCA mobile PIN or Access Code

Generally, customers will create an ATM PIN and access code (BCA mobile password) they can easily remember.

However, this doesn’t mean that you should use your date of birth or numbers related to your data, or of your father, mother, spouse, or other family members as a PIN or access code.

Using your date of birth or other personal data for PINs or access codes will make it easier for fraudsters to hack into your bank account and make transactions. Use a combination of alphanumeric passwords that you can remember but is difficult for others to guess.

Finally, avoid writing down your PIN or access code on your phone because it can be easily accessed by others.

Share this information with your family and friends, GoodFriends~